How Can I Maximize Office Expenses and Employee Benefits?

May 03, 2023

This is part of a bigger series that we did for our Ultimate Guide to Maximizing Business Deductions and Write-Offs. Be sure to check out everything that we discussed in that.

Today we are going to be focusing on two key parts, office expenses and employee benefits.

What Is An Office Expense?

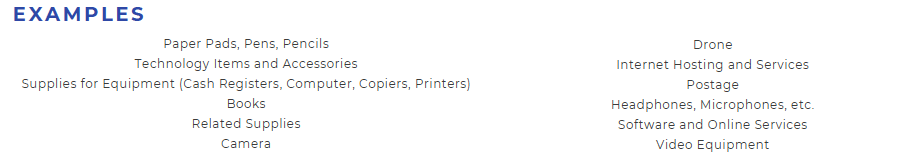

Office expenses are the costs of consumable office supplies, technology, etc. If over a certain dollar amount you will want to capitalize and depreciate. Examples include:

What Planning Opportunities Exist Around Office Expenses?

- Technology Write-Offs

- This is one often overlooked area. When you are buying electronics, think about what you are buying and if it would be viable for a business deduction.

- Examples: Computers, Tablets, Phones and Accessories, Microphones, Cameras, Drones, Projectors, etc.

- This is one often overlooked area. When you are buying electronics, think about what you are buying and if it would be viable for a business deduction.

- Subscriptions or Memberships

- Find a business purpose to these subscriptions so you can run them (or at least a portion) through the business.

- Examples: Costco, Amazon Prime, Newspaper, Magazines, etc.

- Find a business purpose to these subscriptions so you can run them (or at least a portion) through the business.

What Is An Employee Benefit Expense?

Contributions to employee benefit programs include those to education, recreation, health and welfare programs. Amounts paid by the business as employer contributions to a pension, profit-sharing, or annuity plan for employees are deductible.

Examples include:

- Employer Contributions to: Solo 401k, SEP IRA, 401k, Health Reimbursement Plan, Health Savings Plan, Pension Plans

- Plan Design and Implementation Costs

What Planning Opportunities Exist Around Employee Benefits?

- De Minimis Fringe Benefits

- Get a deduction (and tax free to the recipient) for the cost of giving you or employees "de minimis benefits". De Minimis = Small (~$70 or Less) and Not Frequent

- Examples:

- Holiday or Birthday Gifts

- Flowers, fruit, or similar items provided under special circumstances (for example, on account of illness, a family crisis, or outstanding performance).

- NOT Included (aka Taxable): Cash, Cash Equivalents, Gift Cards, Coupons, etc.

- Employee Entertainment

- “expenses for recreational, social, or similar activities (including facilities therefore) primarily for the benefit of employees” qualify for the 100 percent deduction.

- MUST be primarily (50% or more) for the benefit of employees other than a tainted group. A tainted group includes: highly compensated employees and an individual or family member of individual owning 10% or more.

- Examples: Holiday parties, annual picnics, summer outings, maintaining a swimming pool, baseball diamond, bowling alley, or golf course.

Note: Payment of a health club or gym membership for employees would be considered a taxable fringe benefit. This would be deductible by the business but would need to be included in the income of the employee. If you are paying for your personal gym membership it would not be a deductible business expense. There would be an exception if the membership was a requirement for your specific job (example: personal trainer it could be deductible if you used the membership for access to train your clients).

Again, this is just a nibble into some planning opportunities to help you maximize your business deductions. I want to encourage you to check out our full series on this in our Ultimate Guide to Maximizing Business Deductions and Write-Offs to also understand what you need to ensure you are doing to protect yourself and provide full documentation as well.

Remember, do not get greedy and always do the sniff test. If I was explaining this business purpose to an IRS auditor, would it sound legit?

The Time Is NOW To Start Paying Less In Taxes. Join TaxElm and start eliminating taxes and growing your wealth!

What you'll get:

- Tax Savings Blueprint and Training: This is your roadmap to hit the ground and start implementing. Know exactly which strategies are relevant to you and which ones you should focus on first! Then dive into the training library with content, videos, downloads, guides, templates, etc. and start implementing right away!

- Unlimited Access to Tax Experts: Got a specific question about a tax rule? You’ll have unlimited messaging access directly with-in the software to our team of tax experts to get the accounting and tax answers you need.

- Annual Comprehensive Consultation: Once a year you get a live meeting with a tax expert to discuss anything tax savings you would like. This is your time to get your questions answered live 1-on-1.

- Annual Tax Return Review: Each year, upload your prior year tax returns, and our expert team will meticulously analyze them to generate a custom report highlighting key findings and actionable savings strategies tailored to your specific tax situation.

- Monthly Webinars and Training: Every month, we host a live, virtual training session on a key tax topic. Join us live and bring your questions or view the training on your own schedule (recordings are added to the tax training library).

- Partner Directory and Discounts: You get exclusive, members-only rates and access to our expert referral network for accounting, bookkeeping, tax preparation, payroll, financial planning, legal, retirement planning, tax resolution, and more!

- TaxElm Guarantee: We will present tax saving strategies that will, at a minimum, cover the cost of your subscription fee or your money back!

It is like having a tax strategist walking with you along this entrepreneurial journey!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.